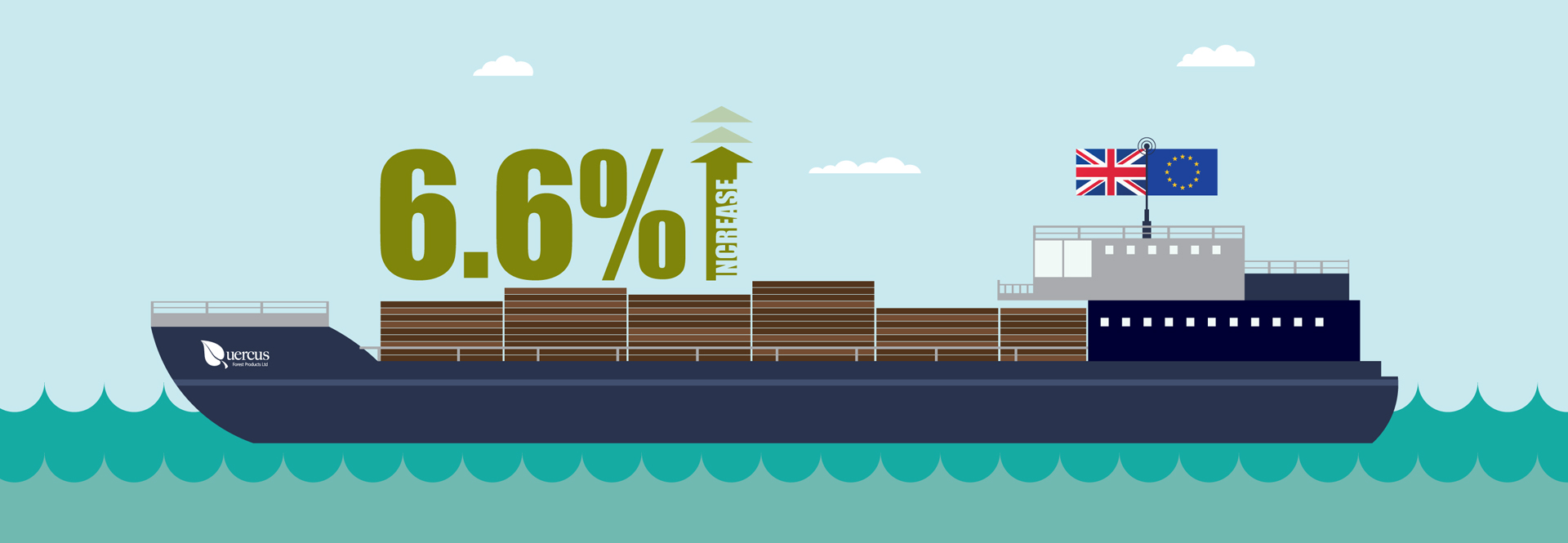

“Hardwood is continuing to show solid gains and stability in the run up to Brexit”.

When the decision to leave the European Union was announced, economic predictions came hard and fast – and few of them were positive. The timber trade is no exception, and if naysayers were to be believed, the hardwood market should be in decline by now. Here’s the latest news from the Timber Trade Federation’s October figures: it’s not. In fact, far from it. While hardwood is hardly booming, it’s continuing to show solid gains and remarkable stability as the country prepares for Brexit.

One importer recently told the press: “some delayed orders suggest there’s more market anxiety as the Brexit countdown really gets underway. But forecasts trade would enter a tailspin as we approached the date haven’t materialised.” Another concurred, saying “we’re not breaking records, but if you’d told me after the EU referendum that business would be where it is now, I’d have snapped your arm off!”

Of course, there is still room for the hardwood market to change as Brexit looms. The Construction Products Association has recently lowered its forecast for overall construction growth next year to 0.6%. But the fact that the same organisation is maintaining its 5% prediction for housebuilding growth this year, and holding as high as 2% in 2019, demonstrates that the perception is far from doom and gloom.

Geo-political issues are not just confined to this part of the world. The ongoing trade war between China and the US has had muted impact on UK hardwood thus far, but it is possible that tariffs could weaken Chinese demand for US hardwood, leading to it flooding the European market. One trader said that the political unpredictability of the last few years simply made it too difficult to predict: “we may be in for a period where there’s simultaneously greater availability of European hardwood and more timber offered by the US due to Chinese tariffs, leading to a wider market softening. Then again, in a few months Chinese buyers could be all over European hardwood. Basically, it’s no time for risk taking.”

The prevailing mood is one of cautious optimism, with traders hoping that 2018’s stable, incremental, growth continues to be the trend into 2019. As one importer said: “Brexit may result temporarily in a stickier supply chain, but working with partners across Europe and worldwide, we’ll find solutions. It’s in everyone’s interests, suppliers and buyers alike.”